Introduction

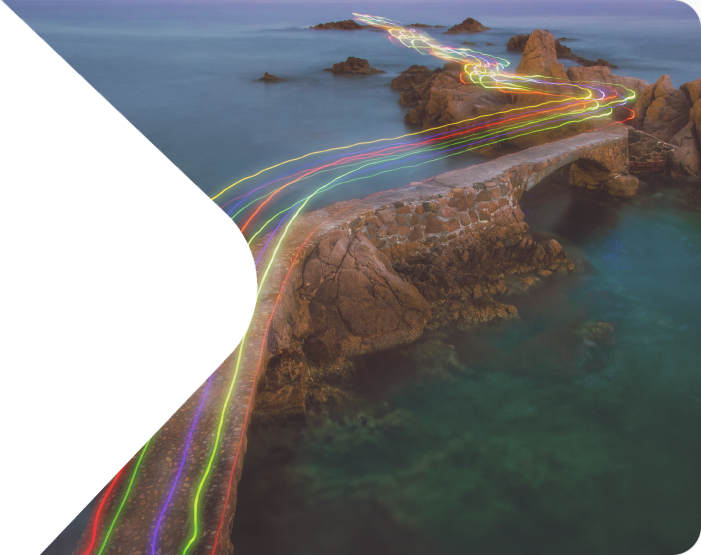

The Tokenbridge proposition provides Fund Managers with an open-architecture fund tokenization solution enabling them to better connect with multiple distribution options and end investors, taking advantage of our blockchain agnostic approach and interoperability; any fund token on any blockchain distributed through any channel.

Tokenbridge, using our wealth of technological expertise and experience in the fund management sector, create solutions that:

- Enable and support Fund Managers in the tokenisation of their assets;

- Connect Fund Managers to distributors as efficiently as possible through a range of blockchain networks supported by standardized APIs;

- Promote the distribution of tokenized assets to investors through aggregation and interoperability with personalization tokens; and

- Support any token on any network for any distributor throughout the investment process.

We offer support to Fund Managers (and their service providers) as they learn how to tokenize their funds, and provide tools to guide them on that journey, or software to assist them in the operation and distribution of a tokenized fund.

We can also help connect distributors (Advisers, Wealth Managers, Discretionary Fund Managers) to tokenize portfolios or funds through industry standard APIs.

And we offer support to third party tokenizers as they digitize information and preferences such as KYC and suitability. Interaction through smart contracts with asset tokens enables hyper-personalization.